Green mortgage

How does the mortgage application process work?

We prepare a tailor-made offer and a list of the required documents at the branch, over the phone or online.

Once the documents have been provided, we will prepare the application and arrange for a land registry extract and property valuation on your behalf. We also offer you the opportunity to take out an insurance policy.

We assess your income, the property and let you know if your mortgage has been approved. The assessment usually takes up to five business days.

We prepare contract documentation, which you then sign at the branch. You can draw the money online in one lump sum or gradually, depending on the purpose of the mortgage.

Sjednejte si novou hypotéku se slevou 0,3 % z úrokové sazby. Stačí ji splácet z účtu, na který vám každý měsíc přijde aspoň 15 000 Kč a 5× měsíčně zaplatit kartou. Nenechte si tak ujít třeba 21 253 Kč ročně. Právě tolik mohli naši klienti v průměru získat ze Světa výhod v minulém roce.

Kompletní pravidla akceCalculate a custom mortgage online

You can calculate your payments and guaranteed interest rate online in a few minutes and without obligation. Simply enter a few details about yourself and the purpose for which you wish to use the mortgage.

- The offer is completely non-binding

- Interest rate guaranteed for 30 days

- You can return to a saved offer at any time

How to apply

Why is it worthwhile to buy a cost-efficient home?

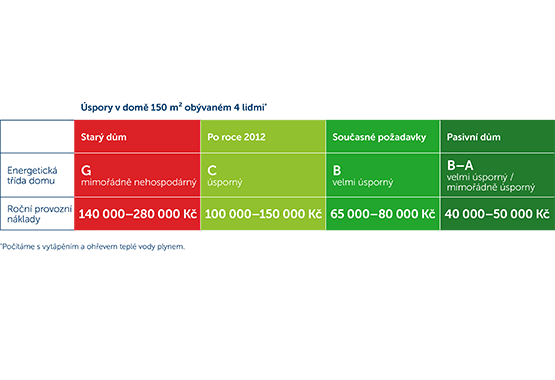

Every house is different. The time it was built, where it was built, the money that went into it, and your habits and behaviour all determine how much it will cost you per year. Housing, electricity, water and fuel costs account on average for around 25% of regular monthly household expenditures in the Czech Republic. Our example shows how annual costs can vary in different energy classes.

Just imagine what you would be able to do in retirement with the more than CZK 1,000,000 you would have saved over 25 years of running a very economical house (compared to an extremely inefficient house).

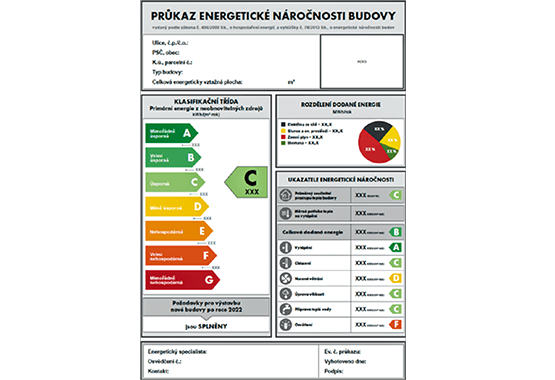

What is an energy performance certificate (EPC)?

The energy consumption of a building includes energy for heating, hot water, cooling, ventilation and air conditioning, and lighting. The building is then classified into one of seven energy performance classes (A to G), ranging from "extremely energy efficient" (A) to "extremely wasteful" (G).

An energy performance certificate is required:

- when applying for a building permit or building notification

- for renovation – if more than 25% of the building envelope is renovated

- when selling or renting a house

Live efficiently with state support

The state offers significant assistance in reducing the energy consumption of your home, whether it is a new or previously built single-family home. Save costs and nature with the most accessible financial support instrument – the New Green Savings Programme (NGS) 2021+.

Zajímá vás, jak si udělat bydlení úspornější?

Stáhněte si náš nový eBook zdarma. Najdete v něm užitečné rady a tipy, na co se při stavbě či rekonstrukci zaměřit, abyste mohli bydlet lépe a úsporněji.

FAQ

Can I take out a mortgage if I have nothing saved?

We can lend up to 90% of the value of the mortgaged property to clients under the age of 36 (otherwise max. 80%). If you own your own land, we can also count the value of the land and other real estate as equity when you build your house, i.e., it can be used as collateral for the loan, so you won't need at least 10% of your own funds.

How long will everything take before I can draw on the money?

The length of mortgage processing is individual and depends to a great extent on the length of the property valuation. It usually takes five business days for the loan application to be assessed once all the necessary documents have been submitted.

What documents will I need to apply for a mortgage?

This depends on the purpose of your mortgage, your source of income and the subject of the collateral. Some documents, such as a recent extract from the land registry, a cadastral map or a property appraisal, we will procure ourselves to save you the time of going to the authorities. We will need proof of identity, documents for the purpose of the loan – the purchase contract, the construction contract and proof of regular income. Our clients have even simpler processing because they usually do not have to prove their income.

How does property valuation work?

It always depends on the specific property. If it's an apartment or a house in a community with more than 10,000 inhabitants, we can make an estimate of the property online free of charge. In other cases, our expert or outsourced appraiser will perform a free property valuation.

What insurance will I need for my mortgage?

The mortgage loan is secured by a lien on the property, which must be insured. It is also advisable to insure your ability to repay the mortgage. Life insurance can help you avoid future risks associated with the inability to make payments, for example, due to loss of employment, accident and incapacity to work.

Sazebník

| Vybrané služby | Cena |

|---|---|

| Expresní ocenění bytu (pomocí cenové mapy pro vybrané lokality) | zdarma |

| Poskytnutí úvěru na bydlení | zdarma |

| Zaslání výpisu k úvěru e-mailem | zdarma |

Poplatky uvedené v této části jsou výňatkem z plného znění, které naleznete včetně termínu jejich splatnosti v našem Sazebníku. Všechny úrokové sazby jsme pro vás připravili v přehledu.

Mortgage for energy efficient housing model

- Provider: Hypoteční banka, a.s.

- Provider: Československá obchodní banka, a. s.

- Total loan amount: CZK 3,350,000

- Deadline for the one-time release of the full loan: 12 months after the contract is signed

- The duration of the loan from the date funds are released: 30 years

- Fixed interest rate: 4.89% p.a. with 3-year fixation

- Annual Percentage Rate of Charge (APR): 5.64%

- Total amount paid by the client: CZK 6,838,618

- Monthly payment: CZK 17,759

- Number of payments: 360

- Two people are applying for the loan

- The loan must be secured by a lien on the property; the example above involves a lien on a property with a value of at least CZK 4,785,720

- Arranged direct debit from a current account that has been held with ČSOB/Poštovní spořitelna for at least three months

The monthly payment referred to above includes the monthly payment of principal, interest and the recurring charges listed below, paid on a monthly basis.

The calculation of the APR and the total amount paid by the client takes into account the expected payment of one-off fees on the dates and in the amounts shown below:

| One-off fee | Anticipated payment date | Anticipated amount |

|---|---|---|

| Reimbursement of cost of property valuation* | For taking out the mortgage | CZK 0 |

| Administrative fee for the application for registration of a lien (paid to the administrative authority) | For taking out the mortgage | CZK 2000 |

| For verification of two signatures (paid to the administrative authority) | For taking out the mortgage | CZK 100 |

| Mortgage fund release based on the submitted application for lien registration in the land registry | For taking out the mortgage | CZK 2,200 |

| First fund release requested at a branch or by mail | When drawing on funds 12 months after signing the loan agreement | CZK 1,000 |

| For sending an instruction to delete the lien from the land registry, including the related administrative fee in the total amount of | Upon loan termination | CZK 3,000 |

In addition, the anticipated payment of recurring fees on the dates and in the amounts set out below has been taken into account:

| Recurring fee | Anticipated payment date | Anticipated amount |

|---|---|---|

| For loan administration (with the No Loan Administration Fee option, with this fee reflected in the interest rate of the loan) | At the end of each month for the duration of the loan | CZK 0 |

| For sending a loan statement by email | At the end of each month for the duration of the loan | CZK 0 |

| For life insurance | At the end of each month for the duration of the loan | CZK 993 |

| For property insurance | At the end of each month for the duration of the loan (once the loan is drawn on) | CZK 210 |

| Mailing confirmation of interest paid for the calendar year | As of January 15 each year for the duration of the loan (once the loan is drawn on) | CZK 150 |

* the property valuation fee is free of charge with the Mortgage for energy efficient housing

Conditions for obtaining the interest rate and a free valuation

The interest rates for special-purpose loans up to 90% of the value of the property with a fixation period of 1, 3, 5, 7 and 10 years include:

- a discount for mortgage payments by direct debit from an existing current account held with ČSOB or Poštovní spořitelna for at least three months on the condition of an account balance in the amount of at least 1.5 times the monthly mortgage payment

- discount for mortgage payments by direct debit from the co-borrower's current account with ČSOB or Poštovní spořitelna along with a property insurance policy from ČSOB Pojišťovna. This discount can be replaced by a discount for taking out a life insurance policy with ČSOB Pojišťovna.

If any of these conditions are not met, the interest rate is increased by 0.3 percentage points. The interest rate applies if two people apply for the loan.

The interest rates of the American mortgage are valid provided that two persons apply for the loan and that they set up a direct debit from a current account they have had with ČSOB or Poštovní spořitelna for at least three months.

Failure to meet any of the above conditions is not a barrier to receiving a mortgage loan, but in this case you are not entitled to the relevant interest rate. For more information on the conditions for obtaining the interest rate, please contact the branches of ČSOB and Poštovní spořitelna.

A free property valuation can be obtained when you apply for a valuation as of 17 February 2020. This special offer is valid until revoked.

Failure to meet any of the above conditions is not a barrier to receiving a mortgage loan, but in this case you are not entitled to the relevant interest rate. Calculations are only estimates. The actual financing options will be communicated to you by ČSOB based on an assessment of your specific situation.

Important notice:

This document is not a proposal for concluding an agreement.

Please also note that all calculations and data shown, including the interest rate and loan payment amount, are for illustrative purposes only. The above example is based on parameters corresponding to those of an average loan currently provided by a bank. The final parameters of the loan may vary depending on your credit rating and the results of your credit assessment and will be set out in pre-contractual information and the loan agreement.

ČSOB Mortgage contracts are concluded by Československá obchodní banka, a.s. as an independent intermediary exclusively on behalf of the provider, Hypoteční banka, a.s., a member of the ČSOB Financial Group. It does not provide advice pursuant to Act No. 257/2016 Coll. on consumer loans.

Loan provider: Hypoteční banka, a.s., the insurance provider is ČSOB pojišťovna, a.s.

Representations

All information given here is of an informative nature. This website does not constitute an offer to conclude a contract, a promise to conclude a contract, an announcement of a public tender for the most suitable offer, a public offer or any other legal action by ČSOB or Hypoteční banka. This is regardless of their content or designation; if any information has the content of a legal act of ČSOB or Hypoteční banka, it is exclusively a legally non-binding informative communication, even when not specifically designated as such.